Flexible Packaging Market Growth Driven by Plastics, Pouches, and Recycling Innovations

Flexible packaging is a means of packaging products using non-rigid materials, which allow for more economical and customizable options. It is a relatively new method in the packaging market and has grown popular due to its high efficiency and cost-effective nature.

Ottawa, Sept. 19, 2025 (GLOBE NEWSWIRE) -- Flexible packages are the ones made from elastic—flexible materials which are easily formed after filling them with a product. The main material used in production is plastics. To the flexible packages belong films and flexible laminates used as wrapping of the product and the package. They are used in retail and institutional food and non-food as well as in industrial applications, retail, consumer storage and trash bags, bags, wraps, shrink, and stretch films.

Flexible packaging is any package or part of a package whose shape can readily be changed when filled or during use. Flexible packaging is produced from paper, plastic, film, aluminum foil, or any combination of those materials, and includes bags, pouches, liners, wraps, rollstock, and other flexible products.

Flexible packages are particularly useful in industries that require versatile packaging, such as the food and beverage, personal care, and pharmaceutical industries.

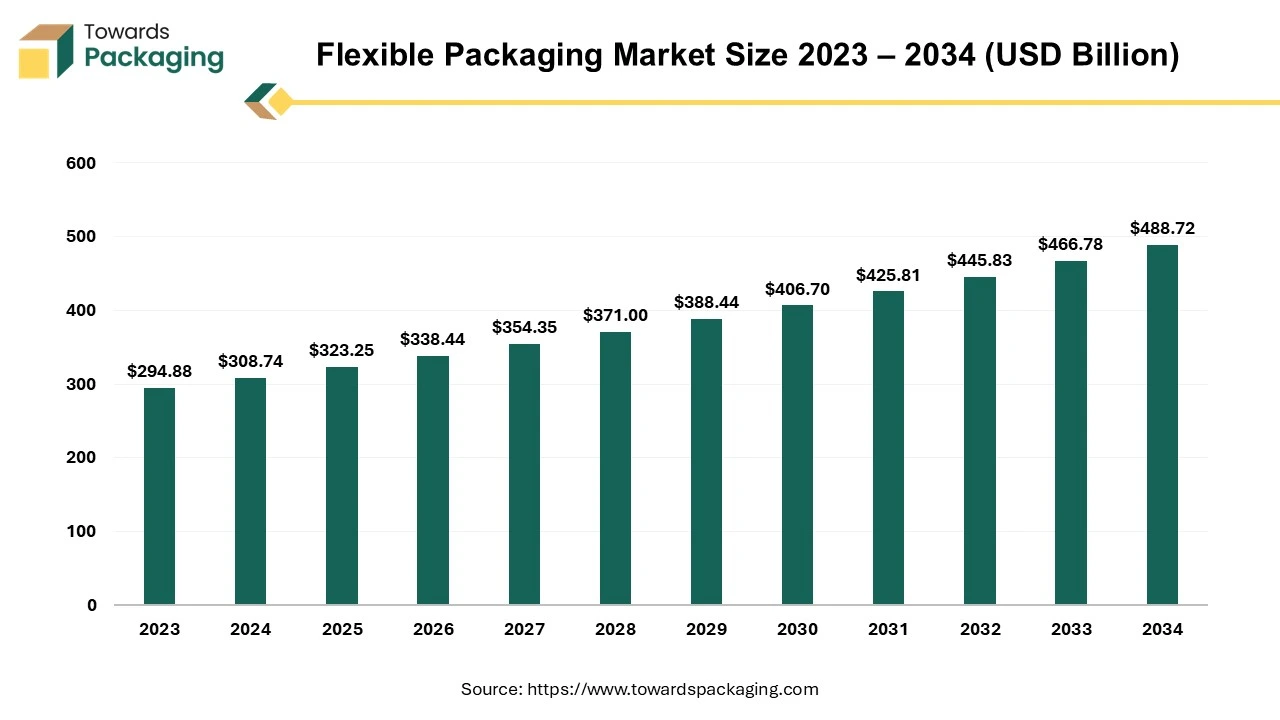

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

Major Key Insights of the Flexible Packaging Market:

- Asia Pacific dominated the flexible packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By raw material, the plastics segment dominated the market with the largest share in 2024.

- By packaging type, the pouches segment registered its dominance over the global flexible packaging market in 2024.

- By printing technology, flexography segment is expected to grow at significant rate during the forecast period.

- By application, the food & beverages segment dominated the flexible packaging market in 2024.

Types of Flexible Packaging

Flexible packages can take a variety of physical forms. Wraps consist of a layer of material surrounding the product or products, and can be classified as intimate wraps, which make direct contact with the product, or as bundling wraps, used to join together two or more products so they can be handled as a single unit. The largest use of plastic film is in stretch wrap for unitizing pallet-loads of goods.

Stretch wrap functions by utilizing the elasticity of the plastic film, which causes it to try to return to its original dimensions when it has been stretched, to provide the restraining force. Over time, this force decreases due to relaxation within the plastic. Shrink wrap also uses elasticity, in this case using a film which has been oriented and exposing it to an increased temperature which provides the energy needed for the molecules to be able to relax to closer to their pre-orientation dimensions. Shrink wrap is commonly used for small wraps, and stretch wrap for larger ones, although both can be used in a variety of sizes.

Bags can be regarded as having three formed sides, and pouches as having four sides. However, the terms are often used interchangeably. For example, we refer to bag-in-box packaging for cereal, when clearly the flexible package inside the paperboard carton is a pouch. The sides of the flexible package can be formed by folding the film, using a tube, or by joining two edges together. Joining is most commonly done by heat-sealing, which requires use of plastic.

Stand-up pouches, one of the most rapidly growing forms of flexible packaging, are pouches which, when filled with product, are capable of standing upright on a shelf, and can serve as replacements for rigid containers.

Segmental Insights

Plastic Segment Held the Largest Share in 2024

The plastics segment dominated the flexible packaging market in 2024. Plastic is cheaper to produce and transport compared to alternatives like glass and metal. Plastics offer high strength-to-weight ratios, reducing shipping costs. Plastic material can be molded into various forms like pouches, wraps, and films. Plastic material allows for high-quality printing and branding customization. Flexible plastics offer tamper-proof and secure packaging solutions.

Pouches Segment to Show Significant Share in the Upcoming Years

The pouches segment accounted for a significant share of the market in 2024. Pouches use less material than rigid packaging, reducing manufacturing and transportation costs. Multi-layered films of pouches offer strong protection against moisture, oxygen, and contaminants. Many pouches are now made with recyclable or biodegradable materials. Mono-material pouches improve recyclability and meet regulatory demands. Flexible and durable, reducing risk of damage during shipping. Pouches are ideal for direct-to-consumer brands and online grocery markets.

Flexography Segment Led the Market in 2024

The flexography segment led the global flexible packaging market. Flexography printing technology Works on a wide range of substrates like plastic films, paper, foil, and biodegradable materials. Faster printing process compared to other methods like gravure. Flexography printing technology is ideal for printing on flexible packaging formats like pouches, bags, and wraps. It is water-based and UV-curable inks which reduce environmental impact. Flexography printing technology supports special effects like metallic finishes and matte-gloss combinations. Flexography printing technology ensures strong adhesion on flexible surfaces, making prints resistant to smudging or wear. Flexography printing supports special effects like metallic finishes and matte-gloss combinations. Works well with sustainable and recyclable packaging materials.

Expansion of Food & Beverage Industries to Project Dominance in 2024

The food & beverage segment dominated the flexible packaging market globally. Urbanization and changing lifestyles in developing countries drive demand for packaged foods. Flexible packaging provides an affordable and efficient solution for local and multinational food brands. Flexible packaging allows high-quality printing and design customization to enhance brand appeal. Online grocery shopping and food delivery services require flexible, tamper-proof, and secure packaging. Flexible packaging solutions like pouches, sachets, and wraps enhance portability and shelf life. Growth in ready-to-eat meals, snacks, and frozen foods increases the need for lightweight, durable packaging.

More Insights in Flexible Packaging

- Leak-Proof Flexible Packaging Market - Insights 2025: Amcor-Berry Merger Reshapes Competitive Landscape

- Renewable Material Packaging Market - Leadership in 2025: Paper & Paperboard Hold 38% Share, Flexible Packaging at 56%

- Flexible Industrial Packaging Market - Led by Plastics and FIBCs in 2025

- Recycled Polypropylene in Packaging Market - 2025 Analysis: Flexible Packaging Leads, Rigid Segment Rising Rapidly

- PVC Packaging Film Market - Surges in 2025 with 25% Spike in Flexible Demand and 15% Uptick in Recycled Use

- Polyethylene Packaging Market - Innovations: AI, Sustainability & Flexible Formats Leading Market Growth

- Recycling Flexible Packaging Market - Strategic Growth, Innovation and Investment Trends

- Converted Flexible Packaging Market - Research, Consumer Behavior, Demand and Forecast

- Multilayer Flexible Packaging Market - Analysis, Demand, and Growth Rate Forecast 2034

- Flexible Polyurethane Foam Market - Demand, Size, and Growth Rate Forecast 2034

- Flexible Plastic Pouches Market - Recycling Rates and Technologies

- Medical Flexible Packaging Market - Trends, Share, and Growth Analysis 2034

- Flexible Paper Packaging Market Size - Drives at 4.58% CAGR

- Nutraceutical Flexible Packaging Market - Size, Trends, Share, and Innovations 2034

- E-commerce Flexible Packaging Market - Research Insight 2034

- Flexible Plastic Packaging Market - Driven by 5% CAGR (2025-34)

- Compostable Flexible Packaging Market - Size & Investment Opportunities

- Metalized Flexible Packaging Market - Growth, Innovations, and Market Size Forecast 2034

Regional Insights

Asia’s Expanding Pharma Sector to Promote Dominance

Asia Pacific region held the largest share of the flexible packaging market in 2024, owing to expanding pharmaceutical industry and rise in demand for convenient packaging. Asia-Pacific serves as a major exporter of flexible packaging materials and finished products. Countries like China, India, and Japan dominate global flexible packaging supply chains. Increasing penetration of online shopping in Asia Pacific region fuels demand for lightweight, durable, and tamper-proof packaging. Expanding middle class with increasing disposable income boosts consumption of branded and convenience products. The flexible packaging lower production and labor costs make Asia-Pacific a global hub for flexible packaging production.

North America’s Largest Food & Beverage Industry to Support Growth

North America region held the largest share of the flexible packaging market in 2024, owing to growing food & beverage industry in the region. High demand for packaged, processed, and convenience foods in North America has driven the market growth. Growth of ready-to-eat meals, frozen foods, and snack segments. Demand for resealable pouches, single-serve packs, and easy-to-use packaging. Major packaging companies like Amcor, Sealed Air, Berry Global, and Mondi are headquartered or have significant operations in North America. Well-established logistics and transportation networks support packaging production and distribution.

U.S. Flexible Packaging Market Trends

U.S. flexible packaging market is growing at fastest rate due to strong food & beverage industry. U.S. regulations promoting recyclable, compostable, and biodegradable packaging. Growth in frozen foods, ready-to-eat meals, snacks, and beverage packaging in the U.S. region. Adoption of smart packaging with QR codes, NFC, and RFID for product tracking and authentication. Strong R&D and advancements in printing, coatings, and laminates in U.S. region to drive the market growth.

North America Flexible Packaging Market Size, Demand and Trends Analysis

The North America flexible packaging market is expected to increase from USD 84.9 billion in 2025 to USD 123.07 billion by 2034, growing at a CAGR of 4.23% throughout the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing flexible packaging which is estimated to drive the North America flexible packaging market over the forecast period. The North America flexible packaging market is experiencing steady growth, driven by rising consumer demand for convenience, sustainability, and innovation in packaging solutions.

Europe’s Well Established Cosmetic Industry to Show Notable Growth

European is seen to grow at a notable rate in the foreseeable future. EU Regulations strict environmental laws, such as the European Green Deal and Single-Use Plastics Directive, push companies toward recyclable, biodegradable, and compostable flexible packaging. Growing eco-consciousness in Europe region drives demand for packaging with lower carbon footprints. The European food industry, particularly in snacks, ready-to-eat meals, and frozen foods, relies on flexible packaging to enhance shelf life, convenience, and portability. The European Plastics Pact and country-specific recycling targets promote investment in recyclable flexible materials. Companies are focusing on mono-material packaging (e.g., 100% polyethylene or polypropylene) for easier recycling.

Recycling Flexible Packaging Market Size and Regional Production Analysi

Recycling flexible packaging comprises collecting and processing resources such as pouches, bags, and bottles into new products. This procedure sometimes distinguishes the resources from separate impurities and removes them before redesigning them into a different material. It is a process that reduces the waste materials from the landfills. It is estimated that around 50% of flexible packaging is recyclable in the U.S. All the plastic used in grocery bags, bread bags, and other products is made up of polyethylene, which can easily be recycled. These types of packaging require non-rigid resources that permit more customizable and economical options.

Germany Flexible Packaging Market Trends

Germany flexible packaging market is growing owing to stringent regulatory laws imposed by the German government in the country. Germany is the margest market in Europe for flexible packaging, driven by strong manufacturing and food industries. The Germany country is pioneer in recycling with strict packaging waste laws (e.g., VerpackG law). Growth in biodegradable and recyclable films due to high environmental awareness. Major investments in smart and active packaging (e.g., temperature-sensitive and antimicrobial films).

Germany Flexible Packaging Market Growth

The Germany flexible packaging market is expected to increase from USD 14.65 billion in 2025 to USD 21.30 billion by 2034, growing at a CAGR of 4.25% throughout the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing flexible packaging. The Germany Flexible Packaging Market refers to the industry engaged in the production and distribution of packaging materials that are non-rigid in nature, such as pouches, bags, wraps, and films.

Walki Westpak Adds Printing Capacity for Increased Flexible Packaging Demand

During the last years, Walki Westpak has experienced rapid growth, driven by growing customer demand for high-quality, sustainable flexible packaging solutions for food products such as sausages, cheese, chocolate and fish. To maintain the exceptional flexographic print quality and top-notch service Walki Westpak has always been known for, it was essential to invest in additional production capacity to safeguard responsiveness and flexibility.

“Our customers expect short lead times and the highest print quality, even for short-run campaigns, which are often driven by fast-changing consumer trends and retail demands,” says Jonas Skuthälla, Head of Sales, Flexible Packaging.

The investment entails two parts. The first is a state-of-the-art flexographic printing line, prepared for printing with both water-based and solvent-based inks. The new line enhances both sustainability and efficiency by enabling environmentally friendly printing with less waste and energy use.

The second is a new post-processing hall, which will improve workflow and material logistics while also enhancing workplace safety by streamlining traffic and separating operational zones more effectively. The relocation of finishing operations will free up space for all printing machines to be centralized in one area, boosting overall productivity. A new prepress mounting unit is being installed, and renovation work has been done to office spaces to accommodate the changes.

Future-proof packaging for a circular future

Recyclable flexible packaging, including lightweight monomaterial solutions for polymer-based products, is becoming increasingly important in response to new legislation, changing consumer expectations and sustainability requirements.

“This investment reflects our commitment to offering recyclable and material-efficient packaging solutions that meet the evolving demands of the market and is a critical step in securing our future competitiveness. With these investments, we are also embracing the latest technology to help future-proof solutions for our customers,” says Sune Kapténs, Head of Production Cluster Converter.

The investment will also have a positive impact on employment in the Säkylä region, as 10 new employees have been hired to support the expanded operations.

The staff has undergone machine-specific training, and the new premises are ready to welcome orders.

“Customers are warmly welcome to visit us to see the new printing line in action,” says Kapténs.

Strategic Acquisition: Arabian Flexible Packaging

Napco Investment LLC, a Dubai-based subsidiary of Napco National, has completed the strategic acquisition of Arabian Flexible Packaging from the Ghurair Group, effective 1 August 2025. This move expands Napco’s regional footprint, boosts operational capabilities, and supports the UAE’s local content and In-Country Value (ICV) initiatives, reinforcing our commitment to sustainable growth and delivering added value to customers and partners across the region.

With this expansion, Napco aims to unlock new synergies, enhance innovation, and extend our service reach to even more customers across the Middle East, Africa, and Europe. Together, we are shaping the future of flexible packaging.

Greenback and Amcor partner to address flexible packaging waste

Greenback Recycling Technologies has announced the first UK deployment of its Enval recycling module at Amcor’s facility.

The module’s installation at Heanor, Derbyshire, will ‘provide learnings’ for scaling circularity as it will predominantly convert household post-consumer flexible packaging waste in a six-month commissioning and trial phase.

Greenback’s recycling technology is designed to process post-consumer flexible packaging and convert it into pyrolytic oil, suitable for producing food-grade plastics.

The entire recycling process will be verified using the eco2Veritas traceability platform. This software uses AI and IoT devices to capture all process data from the receipt of waste through to the production of pyrolytic oil.

The oil carries digital certificate of provenance, which is passed onward in the value chain providing crucial data for mass-balance allocation as the oil is converted into recycled plastics.

Philippe von Stauffenberg, chief executive, Greenback, said: “Hosting this module at Amcor’s Heanor site will enable real-time feedback from global experts, as we refine our system for maximum impact before expanding further.”

Andrew Green, Vice President, Amcor Flexibles Europe, Middle East and Africa, said: “Combining Greenback’s innovation with Amcor’s operational experience enables us to improve circularity for soft plastics and help our customers make progress in achieving their own sustainability targets.”

Flexible packaging firms set for strong 14-16% rebound in sales this fiscal: Crisil Ratings

As per the report, high domestic demand will more than offset the impact of muted exports, of which the US forms nearly 25-30% and will be affected by the recent US tariff hikes. However, stable consumption in other export destinations - Europe, Africa and the Middle East -will support demand.

Rating agency, Crisil Ratings in its latest report has said that flexible packaging manufacturers are set for a strong 14-16% rebound in sales this fiscal, with supply disruptions driving a sharp uptick in realisations amid stable volume growth. It noted that the industry saw muted compounded annual growth rate of 1- 2% over the past three years due to oversupply situation with supply estimated at nearly 1.4x times demand as at end of fiscal 2025. This is likely to change this fiscal as a fire-led disruption at the plant of a major manufacturer, impacted nearly around 18% of the installed capacities, restoration of which will be gradual.

The rating agency further said that the fire related capacity reduction is expected to prune the oversupply to around 1.2x times demand this fiscal despite addition of new capacities and a relatively muted export demand due to US tariffs. This, coupled with rising consumption led domestic demand (around 78% of overall sales), will drive up capacity utilizations from around 72% last fiscal to around 85% this fiscal. Besides, operating leverage benefits stemming from better capacity utilization and improving realisations, will enhance operating profitability by 300-500 bps. Also, higher cash accrual emanating from revenue growth and margin improvement will help deleverage balance sheets, keeping credit profiles stable.

As per the report, high domestic demand will more than offset impact of muted exports of which US forms nearly 25-30% and will be affected by the recent US tariff hikes. However, stable consumption in other export destinations - Europe, Africa and Middle East -will support demand. Even if it assumes a slight moderation in export demand, overall volumes are still expected to grow at a reasonable 3-5% this fiscal. It also said that growth in volumes, higher realisations, stable raw material prices (of polypropylene and polyethylene terephthalate, which are primarily linked to crude oil prices), and operating leverage benefits due to better absorption of fixed costs from increased capacity utilisation, will drive up operating profitability by 300-500 bps to upto 15% this fiscal.

Crisil Ratings also noted that however sustainability of the same remains to be seen as historically, the industry has seen cycles of strong performance with high profitability, followed by chunky capacity additions and oversupply, leading to an industry downturn. Going ahead, restoration of the impacted facility, extent of impact of US tariffs on exports and new capacity additions coming onstream will bear watching.

Flexible packaging is all around us – whether in the form of snack pouches, medicine blister packs, or the labels on bottles and cartons. It is lightweight, versatile, and increasingly sustainable. Yet one persistent challenge shadows its success – inks simply don’t like to stick to plastic films. When adhesion fails, the consequences are visible and costly – smudged graphics, peeling labels, delamination, and even product recalls. For printers, converters, and brand owners, ensuring that inks bond reliably to these surfaces is a matter of both science and business.

Why films resist inks

Unlike paper, which absorbs ink into its porous structure, polymers such as polyethylene, polypropylene, and polyester are smooth, chemically inert, and water-repellent. Their low surface energy means that when ink is applied, it tends to bead up like water on glass rather than spreading evenly. Solvent-based inks have traditionally been used to overcome this, as the solvents lower surface tension and improve wetting. However, environmental pressures and stricter regulations are driving the industry toward alternatives.

Water-based inks, while safer and more sustainable, have higher surface tension and struggle to wet these non-porous substrates. Achieving good wetting is essential because adhesion depends on the ink drop flattening across the surface. If the angle of the droplet remains steep, the print will lack the intimate contact needed for bonding. Coated and treated films, which often measure in the range of 38–56 dynes per centimetre, require inks with even lower surface tension to spread spontaneously.

The invisible barriers

Beyond the natural chemistry of polymers, other factors interfere with adhesion. Additives used during film processing, such as slip or anti-block agents, can migrate to the surface and form an invisible, slippery layer that reduces surface energy. Contaminants from handling – fingerprints, dust, oils, and mold release residues – further obstruct bonding. Even when inks are designed with the right viscosity and colour strength, these surface conditions can sabotage performance.

Ink formulation itself is a balancing act. Solvent-based systems spread easily but raise safety and environmental concerns. Water-based systems are cleaner but dry more slowly and can fail on untreated plastics. To bridge this gap, chemists have introduced new polymers that reduce surface tension, crosslinking agents that strengthen resistance to heat and chemicals, and hybrid resins that combine adhesion with printability. The direction is clear: inks are evolving to grip more stubborn surfaces while remaining compliant with regulations.

Raising surface energy

If adhesion is all about contact, then raising the surface energy of films becomes the natural solution. Techniques such as corona discharge, flame treatment, and atmospheric plasma have become cornerstones of modern packaging production. By bombarding polymer surfaces with energetic ions, these treatments break molecular bonds and introduce polar groups, transforming a surface that repels inks into one that welcomes them.

Corona treatment is fast, effective, and easily integrated into high-speed converting lines. Plasma systems, though more sophisticated, offer precise control and can even clean the surface by burning away microscopic contaminants. Flame treatment remains useful for three-dimensional objects like bottles, while chemical primers are sometimes applied as an anchoring layer before printing.

The benefits of these treatments, however, diminish over time. Additives migrate back to the surface, and molecular chains relax, meaning treated films should be printed quickly or re-treated before use. Quality control tools such as contact angle measurement provide a more reliable indication of treatment success than traditional dyne pens, giving converters greater confidence in their processes.

Business and regulatory pressures

Adhesion is not merely a technical puzzle; it has commercial and regulatory dimensions as well. In sectors such as food and pharmaceuticals, inks must be low migration, ensuring that no harmful components pass through the packaging into the product. This has led to the development of next-generation ink systems formulated without restricted substances and designed to meet strict local and global regulations.

Toward best practices

Achieving consistent adhesion requires discipline across the entire chain – from material handling to final storage. Resin pellets should be properly dried to avoid moisture uptake that weakens bonding. Surfaces must be kept clean, free of oils and dust, and printing or lamination should occur soon after treatment. Packaging stored in unsuitable conditions risks additive migration, which undermines adhesion before it even reaches the press. In some cases, lightly texturing a surface can provide microscopic ridges and valleys that enhance mechanical anchoring for the ink film.

At the forefront of innovation in inks, adhesives, and coatings, GLS Speciality Chemicals has built a strong reputation as a partner of choice for converters and brand owners worldwide. With a deep commitment to sustainability, GLS develops next-generation water-based, solvent-less, and UV-curable solutions that not only ensure superior adhesion on challenging substrates but also align with global compliance and recyclability goals. By combining scientific expertise with state-of-the-art manufacturing and a customer-centric approach, GLS empowers packaging professionals to achieve vibrant, durable, and environmentally responsible results across food, pharma, and consumer packaging segments.

Looking ahead

The story of ink adhesion in flexible packaging is one of convergence between science and commerce. Advances in polymer chemistry are yielding inks that stick to surfaces once considered impossible. Surface treatment technologies are becoming smarter, cleaner, and more integrated into high-speed lines. Regulators and brand owners alike are insisting on solutions that are safer and more sustainable.

For converters and packaging professionals, the challenge is to bring all of these elements together, choosing the right ink, applying the right treatment, and maintaining the right process discipline. The reward is packaging that not only looks vibrant and professional but also stands up to the stresses of handling, transport, and shelf life.

In the end, adhesion is more than just chemistry – it is a reflection of trust. Brands rely on it to ensure their products are recognized and remembered. Consumers rely on it for safety and quality. And as the industry races toward a more sustainable future, ensuring that the printed message sticks has never been more important.

Global Flexible Packaging Market Top Players

- Amcor

- Mondi

- Sonoco Products Company

- Sealed Air

- Huhtamaki

- Transcontinental Inc

- Cosmo Films Ltd

- Polyplex

- UFlex Limited

- Jindal Poly Films

- CLONDALKIN GROUP

- Constantia Flexibles

- TAGHLEEF INDUSTRIES GROUP

- DUNMORE

- Celplast Metallized Product

- Ultimet Films Ltd

- Accrued Plastic Ltd

- All Foils, Inc.

- SRF Limited

Global Flexible Packaging Market Segments

By Raw Material

- Paper

- Plastics

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Others

- Bioplastic

- Aluminum

- Cellulosic

- Metal

By Packaging Type

- Bags and Trays

- Gusseted Bags

- Wicketed Bags

- Pouches

- Stand up Pouches

- Flat Pouches

- Spouted Pouches

- Films

- Bag-in-box

- Blisters

- Others

By Printing Technology

- Flexography

- Digital Printing

- Retrogravure

- Others

By Application

- Food & Beverages

- Pharmaceutical

- Cosmetics

- Others

By Region:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5057

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging, Your Trusted Research and Consulting Partner, Has Been Featured Across Influential Industry Portals - Explore the Coverage:

- Flexible Packaging Market - PACKNODE

- Is it finally safe to ditch your phone case? I put it to the test

- Battery Brands Charge Forward with Plastic-Free Packaging

- Why Non-corrugated Boxes Are the Future of Packaging

- Ampoules Packaging Market Size Expected to Reach $11.27 Bn by 2034

- Flexible plastic pouches projected to boom over the next decade

- GLOBAL PET FOOD PACKAGING MARKET SET TO DOUBLE BY 2032

- The Skinny on the Skin Packaging Market

- Healthcare Goes Green & Sterile

- The Different Types of Adhesives for Paper Packaging

-

Child-Resistant Packaging: Cannabis and So Much More

Towards Packaging Releases Its Latest Insight - Check It Out:

- Flexible Packaging for Beverage Market - 2025 Asia Pacific Leads with 36% Share and North America Set for Strong Growth

- Flexible Green Packaging Market - Driven by 6.24% CAGR

- Sustainable Flexible Packaging Market - Sees North America Holding 40% Share with Asia Pacific Emerging as Fastest Growing Region

- Paper Cores Market - 2025 Sees Rising Demand from Flexible Packaging and E-Commerce Expansion

- Barrier Coated Flexible Paper Packaging Market - Outlook 2025 to 2034: Innovation in Bio-Based Coatings & Digital Printing

- Commercial Packaging Market - 2025 Outlook: Corrugated Boxes Dominate with 35% Share, Flexible Packaging Set to Surge

- Flexible Packaging Adhesive Market - Overview 2025: Asia Pacific Dominates, Solvent-Free Adhesives Gain Traction

- Eco-Friendly Flexible Packaging Market - Trends 2025: Bioplastics and Online Retail Set to Surge

- Asia Pacific Packaging Market - 2025 Insights: UFlex, SIG, Amcor Lead Innovation Amid Sustainability Push

- Next-Generation Packaging Market - Trends 2025: Flexible and Biodegradable Packaging Leads, Asia Pacific Fastest-Growing

-

Paper-Based Sustainable Packaging Market - Trends 2025: Molded Fiber, Flexographic Printing, and B2C Channels Rising

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.